The House of Representatives, Senate, and President have now all acted on S. 2392, the Veterans’ Compensation Cost-of-Living Adjustment (COLA) Act of 2025, sponsored originally by Senate Committee on Veterans Affairs Chairman Jerry Moran (R-KS). The measure passed both the House and Senate chambers and was signed by President Donald Trump on November 25. This year’s COLA kicks in additional compensation for inflation for wartime disability, dependents, the clothing allowance for certain disabled veterans, and Dependency and Indemnity Compensation for surviving spouses and children.

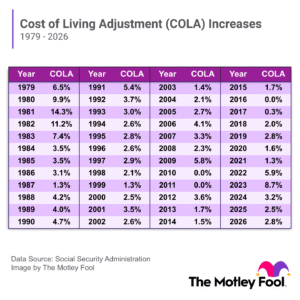

The necessary annual legislation was delayed this year by nearly a month due to the federal government shutdown. It followed the announcement on October 24 of the COLA for Social Security benefits and Supplemental Security Income (SSI). The payments will increase by 2.8 percent beginning in January 2026 for nearly 71 million Social Security beneficiaries and nearly 7.5 million people receiving SSI payments. Some recipients receive both Social Security benefits and SSI.

The legislation is the formality that required VA, effective last Monday, December 1, to increase the amounts by the same percentage as the COLA increase in benefits for Social Security recipients. The bill also requires VA to publish the amounts payable, as increased, in the Federal Register. VA is further authorized under the legislation to make a similar adjustment to the rates of disability compensation payable to persons who have not received compensation for service-connected disability or death.

Over the last decade, the COLA increase has averaged approximately 3.1 percent. The COLA was 2.5 percent in 2025. Although the original Social Security Act was passed in 1935, subsequent legislation ties the annual COLA to the change in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as determined by the Department of Labor’s Bureau of Labor Statistics. Additional information about the current COLA is available by clicking the button below. For additional COLA information, visit the Social Security Administration website.